1099 tax calculator 2020

It also covers legal payments when youre paying someone other than your lawyer. Calculate your self-employment 1099 taxes for free with this online calculator from Bonsai.

How To Calculate Income Tax In Excel

In 2017 Marias state issued her a 500 refund on the amount of tax that was overpaid and sent her Form 1099-G to report the payment.

. Before the tax year 2020 payees reported non-employee compensation vendor sales and specified payments on IRS Form 1099-MISC information returns. For his 2018 2019 and 2020 tax years at least 50 of Chucks total gross receipts were from the trade or business of farming. Print Download My Return.

File 2018 Tax Return. If your average tax liability is more than 100 but less than 1000 per month you will be assigned a monthly filing status. Getting answers to your tax questions.

Forms 1099-A and 1099-C. Set Up a Free Account. As of 2020 those who earn payments of over 600 for non-employee compensation will receive the 1099-NEC form this will be replacing Form 1099-MISC.

Look professional win more clients and manage your business from one place. Use this calculator to view the numbers side by side and compare your take home income. Our homeownership tax benefits guide includes a more detailed calculator which enables users to input more data to get a more precise calculation has been updated to include 2020 standard decutions and the new real estate tax treatments after the passage of the 2017 Tax Cuts and Jobs Act.

Make sure to file your 1099-NEC by January 31st whether youre e-filing or paper filing. File 2017 Tax Return. The 1099-NEC form will be used starting with the 2020 tax year.

2020 Tax Returns were able to be e-Filed up until October 15 2021. In 2020 the IRS split reporting into either Form 1099-MISC or a new form 1099-NEC for nonemployee compensation. Updated for the 2020 - 2021 tax season to ensure accurate results.

2017-2020 Lifetime Technology Inc. Calculating 2022 Marginal Tax Brackets for IRS Payments Due April 17 2023. When you file Form VA-6 you must submit each federal Form W-2 W-2G 1099 or 1099-R that shows Virginia income tax withheld.

Form 1099-MISC is a catchall form for all sorts of payments everything from royalties to prizes. Form 1099-G Certain Government Payments. 2022 Marginal Tax Rates Calculator.

The employer provides these forms to all employees at the end of the calendar year. January 1 - December 31 2020. The Sales Tax Deduction Calculator IRSgovSalesTax figures the amount you can claim if you itemize deductions on Schedule A Form 1040.

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. It only takes a few seconds to set up a FreeTaxUSA account. You must submit Form VA-6 and all W-2 and 1099 forms electronically.

Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. File 2020 Tax Return. The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used.

Since that date 2020 Returns can only be mailed in on paper forms. For that tax year she chose to claim itemized deductions and deducted the 3000 state income from her federal income taxes. Using a 1099-MISC for attorney payments.

Starting in 2020 the IRS chose to reintroduce the 1099-NEC Form as the new way to report self-employment income instead of using Form 1099-MISC. Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. Use the 2020 Tax Calculator to estimate your 2020 Return.

File 2019 Tax Return. This was done to help clarify the various filing deadlines for Form 1099-MISC versus the 1099-NEC filing deadline. Self Employment Tax Calculator 2022.

Prior to the 2020 tax year as a business owner who hired contractors you dealt primarily with Form-1099 MISC for reporting nonemployee compensation. How to Calculate Your 2021 Refund. W-2 forms are tax forms that report all payments made to employees within a year.

The deadline for 1099-NECs. The IRS also issued a new Form 1099-MISC with revised box numbers for reporting. Current Redmond mortgage rates are displayed below.

IRS Income Tax Forms Schedules and Publications for Tax Year 2020. This calculator helps you estimate your average tax rate your tax bracket and your marginal tax. 2021 Tax Calculator to Estimate Your 2022 Tax Refund.

After completing her state tax return she realized she actually only owed 2500. What are W-2 forms. 2021 Income Tax Calculator FreeTaxUSA is a powerful tax calculator.

Tax Withholding For Pensions And Social Security Sensible Money

Income Tax Formula Excel University

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Income Tax Formula Excel University

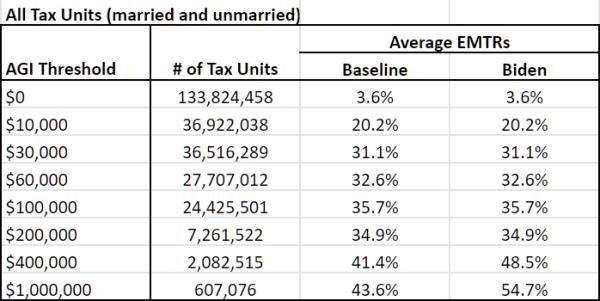

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Create An Income Tax Calculator In Excel Youtube

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Income Tax Formula Excel University

Income Tax Formula Excel University

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Calculate Federal Income Tax